All Categories

Featured

Table of Contents

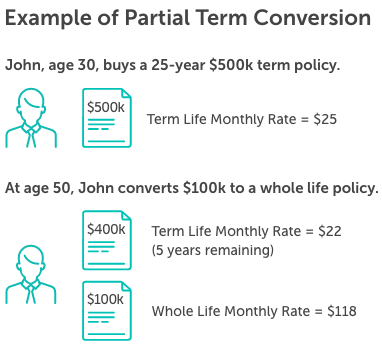

Just select any form of level-premium, permanent life insurance coverage policy from Bankers Life, and we'll convert your policy without requiring proof of insurability. Plans are exchangeable to age 70 or for five years, whichever comes later on - what does level term mean in life insurance. Bankers Life supplies a conversion debt(term conversion allowance )to insurance policy holders as much as age 60 and with the 61st month that the ReliaTerm plan has actually been in pressure

They'll offer you with basic, clear selections and aid personalize a plan that fulfills your individual needs. You can trust your insurance coverage agent/producer to aid make complex financial choices about your future less complicated (life insurance short term). With a history going back to 1879, there are some points that never alter. At Bankers Life, that indicates taking a customized method to aid safeguard the individuals and family members we serve. Our objective is to supply exceptional service to every insurance policy holder and make your life less complicated when it concerns your cases.

Life insurers supply numerous kinds of term plans and typical life plans as well as "passion delicate"products which have actually become extra widespread because the 1980's. An economatic entire life policy offers for a standard amount of getting involved whole life insurance coverage with an additional supplementary protection supplied via the usage of returns. There are 4 fundamental rate of interest delicate whole life plans: The universal life policy is actually even more than interest delicate as it is made to mirror the insurance provider's existing death and cost as well as interest revenues instead than historical rates.

You may be asked to make added costs repayments where insurance coverage might terminate because the interest price went down. The ensured rate supplied for in the policy is much reduced (e.g., 4%).

What To Do When Your Term Life Insurance Is Expiring

In either situation you should receive a certification of insurance describing the arrangements of the group policy and any kind of insurance fee. Normally the maximum quantity of protection is $220,000 for a home loan and $55,000 for all other financial debts. Credit life insurance coverage need not be acquired from the organization granting the finance

If life insurance coverage is called for by a lender as a problem for making a funding, you might be able to assign an existing life insurance policy plan, if you have one. You might wish to acquire group credit score life insurance coverage in spite of its greater expense because of its convenience and its availability, generally without comprehensive evidence of insurability. limited term life insurance.

However, home collections are not made and premiums are mailed by you to the agent or to the company. There are particular factors that have a tendency to boost the costs of debit insurance greater than regular life insurance policy plans: Certain expenses coincide regardless of what the dimension of the policy, to make sure that smaller policies issued as debit insurance policy will have higher premiums per $1,000 of insurance coverage than larger size normal insurance plan

Since early gaps are expensive to a business, the expenses must be handed down to all debit insurance policy holders. Considering that debit insurance coverage is designed to consist of home collections, higher payments and costs are paid on debit insurance coverage than on regular insurance coverage. Oftentimes these greater costs are handed down to the insurance holder.

Where a business has different costs for debit and normal insurance policy it might be feasible for you to purchase a bigger quantity of normal insurance coverage than debit at no additional cost - group term life insurance vs voluntary life insurance. If you are believing of debit insurance coverage, you ought to definitely investigate routine life insurance policy as a cost-saving option.

Level Death Benefit Term Life Insurance

This strategy is created for those who can not initially manage the regular whole life costs yet that want the higher premium coverage and feel they will at some point be able to pay the higher premium (term life insurance singapore). The family plan is a combination strategy that gives insurance security under one agreement to all participants of your instant family husband, spouse and children

Joint Life and Survivor Insurance offers coverage for two or even more persons with the survivor benefit payable at the death of the last of the insureds. Costs are significantly lower under joint life and survivor insurance than for policies that insure just one person, because the probability of having to pay a fatality case is reduced.

Costs are dramatically greater than for policies that insure someone, given that the probability of having to pay a fatality claim is greater (direct term life insurance definition). Endowment insurance coverage provides for the settlement of the face amount to your recipient if fatality happens within a certain time period such as twenty years, or, if at the end of the specific period you are still active, for the repayment of the face total up to you

Table of Contents

Latest Posts

All Of The Following Are True Regarding The Convertibility Option Under A Term Life Insurance Policy

The Term Illustration In A Life Insurance Policy Refers To

The Term Illustration In A Life Insurance Policy Refers To

More

Latest Posts

All Of The Following Are True Regarding The Convertibility Option Under A Term Life Insurance Policy

The Term Illustration In A Life Insurance Policy Refers To

The Term Illustration In A Life Insurance Policy Refers To